NC opens phase two of Business Recovery Grant program; more businesses eligible for funding

Published 12:05 am Wednesday, May 4, 2022

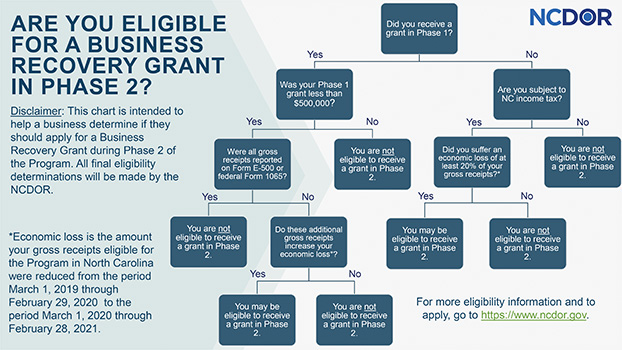

- A flowchart from the North Carolina Department of Revenue helps business owners determine if they are eligible for a grant in phase two of its Business Recovery Grant program.

SALISBURY — More businesses will be eligible to receive funding to help with COVID-19 recovery through phase two of the North Carolina Department of Revenue’s Business Recovery Grant program.

The state launched the second phase of the program on Monday. Businesses have until June 1 to apply.

“We know that we have a healthy business community and with everything the (Rowan Economic Development Council) is doing, with the wonderful announcement of Macy’s in the last couple weeks, there are a number of business doing really well,” said Elaine Spalding, president of the Rowan County Chamber of Commerce. “But we still have so many of our small business really in recovery mode and those are the business we are really encouraging to apply for this phase two of the Business Recovery Grant program.”

The Business Recovery Grant Program issues payments to eligible North Carolina businesses that experienced a significant economic loss due to COVID-19. The first phase of the program closed on Jan. 31. After phase one, over $176 million in reimbursement grants and around $27 million in hospitality grants remained unclaimed.

“For whatever reason, people did not apply before or maybe they applied and didn’t get it,” Spalding said. “I want to make sure we inform everybody who has a chance to apply to please apply for phase two of North Carolina Business Recovery Grant program.”

Legislation passed by the General Assembly and signed by Gov. Roy Cooper in March made more businesses eligible to apply for a grant in the second round of the program.

Phase two authorizes two types of grants:

• A hospitality grant is available to an eligible arts, entertainment, or recreation business, as well as an eligible accommodation or food service business such as a hotel, restaurant, or bar (NAICS code 71 and 72).

• A reimbursement grant is available to an eligible business not classified in NAICS Code 71 and 72.

More businesses will now be able to meet the 20% economic loss requirement. In phase one, a business was required to calculate economic loss using certain gross receipts reported on the following forms:

• Form E-500, NC Sales and Use Tax Return

• Federal Form 1065, U.S. Partnership Return of Income

In phase two, businesses can calculate their economic loss based on gross receipts reported on certain lines of the following forms:

• Form E-500, NC Sales and Use Tax Return

• Federal Form 1065, U.S. Partnership Return of Income

• Federal Form 1120, U.S. Corporate Income Tax Return

• Federal Form 1120-S, U.S. Corporate Income Tax Return-Sole Proprietorships

• Federal Form 1040, Schedule C, Profit or Loss From Business

• Federal Form 1040, Schedule F, Profit or Loss From Farming

By expanding the types of gross receipts that can be used to calculate economic loss, these changes will make the Business Recovery Grant Program available to sole proprietors, corporations and other businesses that do not report gross receipts on Form E-500 or Federal Form 1065. As a result, farmers and businesses that primarily provide services, such as gyms, hair salons and tour guides may now be eligible for a grant or a larger grant.

Additionally, businesses not eligible in phase one because they previously received other COVID-19 relief may be eligible in phase two. In phase one, a business could not receive a reimbursement grant if it received an award from one of the following federal programs:

• COVID-19 Job Retention Program

• Economic Injury Disaster Loan Advance

• Paycheck Protection Program

• Restaurant Revitalization Fund

• Shuttered Venue Operators Grant

In phase two, a business may be eligible for a reimbursement grant if it received an award from one of those programs, provided that the business also:

• Is not classified in NAICS Code 71 or 72

• Suffered an economic loss of at least 20%, and

• Subject to NC income tax under Article 4 of Chapter 105.

Businesses that received a grant in phase one of the Business Recovery Grant program that demonstrate additional economic loss may be eligible for an additional grant in phase two.

For more information, visit ncdor.gov/business-recovery-grant.

To answer questions regarding the application process, the NC Department of Revenue is hosting a webinar Wednesday at 11 a.m. Attendees can register for the event by visiting ncdor.gov. Those with questions about the program can contact the Rowan County Chamber of Commerce at 704-633-4221.