Former Durafiber workers bring class-action suit against Blue Cross, executives

Published 12:00 am Wednesday, November 20, 2019

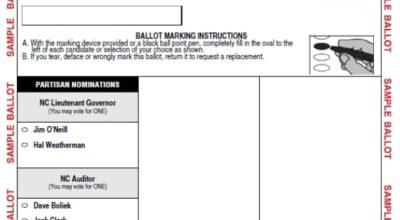

- The former DuraFiber Technologies plant in Salisbury. Allison Lee Islay/Salisbury Post file photo

SALISBURY — Velvie Gray had worked at the Durafiber plant off U.S. 70 since 1978 and kept his job through all the different owners and name changes over the years.

After stints as a “tugger” and working in the spin draw department, Gray went to work in plant maintenance in 1984-85, and he stayed with that section until the plant closed Sept. 12, 2017.

Before the closure, Gray had a medical procedure at Iredell Memorial Hospital on Aug. 21, 2017, staying in the hospital until Aug. 23. His medical expenses exceeded $60,000, and he later learned that Blue Cross and Blue Shield of North Carolina, which he assumed was his health insurance provider, had denied his claims.

After a self-pay discount from the hospital, Gray still owed more than $18,000, toward which he had to make monthly payments. Blue Cross also had declined to pay anything for the prescription drugs and physical therapy he required.

Gray is among five Rowan Countians listed as lead plaintiffs in a class-action lawsuit filed on behalf of former Durafiber workers Monday in Civil Superior Court. They are represented by the Salisbury law firm of Wallace & Graham, with Mona Lisa Wallace and John Hughes as their attorneys.

The other Durafiber workers in the lawsuit are Gary Honbarger, Monica Raney, Crystal Reese and Norman Richard Rufty.

Named as defendants in the case are Blue Cross and Blue Shield of North Carolina; Frank Papa, chief executive officer of Durafiber; Erwin Bette, chief financial officer of Durafiber; and FTI Consulting, the chief restructuring officer that handled the Durafiber bankruptcy.

The suit asks for a jury trial.

The closed plant is at 7401 Statesville Blvd. (U.S. 70). Over the years, depending on ownership, it went by Fiber Industries, Hoechst Celanese, Kosa, Invista, Performance Fibers, and, from 2014 until its closing, Durafiber Technologies.

According to the action, Blue Cross provided group health benefits to Durafiber workers based on “stripped-down coverage under an ‘administrative service only’ or ASO product.”

Under the arrangement, Durafiber had the obligation to fund the health care plan.

The suit alleges Papa and Bette, looking to minimize costs and shed as many company obligations to the workers while plant closings and bankruptcy were underway, knew the ASO arrangement with Blue Cross “would allow them to ignore and avoid paying numerous claims.”

In effect during the bankruptcy, the suit alleges, Durafiber was treating workers with group health benefit claims “like ordinary vendors they could ignore.”

But the plaintiffs claim that even though Durafiber had the obligation to fund the group health plan, Blue Cross had its own duties to “provide truthful and accurate claim information to participants, such as whether there were really funds to pay claims.”

The suit says Blue Cross represented to Durafiber workers that they had coverage. As late as Sept. 27, 2017, Blue Cross was sending written certifications to plan participants that assured them they were covered until Sept. 30, 2017.

The workers carried Blue Cross/Blue Shield cards. They received Blue Cross-drafted benefits booklets through their network providers.

After company officials held a plant meeting in July 2017 about the possible plant closures in Salisbury, Shelby and Winnsboro, many of the Durafiber workers began scheduling medical appointments and procedures because they had been told their insurance coverage would end Sept. 30.

Their premiums continued to be deducted from their paychecks. They learned later from doctors and hospitals that Blue Cross was denying their claims.

“After lengthy delays,” the suit says, “Blue Cross refused to pay the claims, declaring to the aggrieved plan participants that per the Blue Cross ASO contract, which workers never saw, Durafiber had the obligation to fund the plan.

“… As a result, the plaintiffs, who had now lost their jobs after Durafiber closed, were barraged by unexpected medical bills and charges. Many had their credit ratings devastated by no fault of their own,” the suit says.

The suit contends Blue Cross still had obligations to the workers.

“Blue Cross knew or should have known that Durafiber was failing to make payments and was a corrupt ‘plan administrator,'” the action says. “Blue Cross continued to administer the plan as if all was well, assuring plaintiffs they were covered and never warning them otherwise.

“Blue Cross breached its duty to competently manage the plan.”

As for Papa, the suit contends his July 13, 2017, letter to employees misrepresented that the coverage cutoff for their group health plan was Oct. 1, 2017.

The suit also claims Papa and Bette controlled what claims were paid and that FTI Consulting, the restructuring officer, “contributed to cause the failure to pay valid benefit claims of workers receiving medical care under the plan.”

The suit adds, “None of the plaintiffs knew that Durafiber and its top executives were planning to manipulate assets and liabilities so as to leave ordinary workers holding the bag and facing ruinous medical expenses because Durafiber refused to self-fund the benefits plan.”

“It just breaks my heart,” Wallace said in a telephone Monday. “Our clients thought they had (coverage).”

Contact Mark Wineka at 704-797-4263.