Other Voices: North Carolina, land of the fee

Published 4:08 pm Wednesday, January 17, 2018

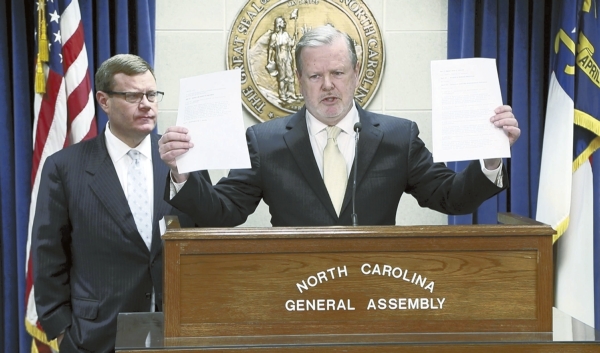

- Republican leaders Rep. Tim Moore, left, and Sen. Phil Berger, hold March 2017 press conference. Will Republicans hold on to their veto-proof majorities in the state House and Senate? AP photo

North Carolina’s Republican lawmakers tout how much they have cut taxes, but they’ve also quietly allowed an increase in what are essentially hidden taxes – state fees.

From the 2011-2012 budget year — the first after Republicans took full control of the legislature — until the budget year 2015-16 (the latest numbers available), the total for state fees collected by all state departments jumped nearly $1 billion from $5.1 billion to $6 billion.

Some of the increase reflects the state’s rising population — more people paying more fees. But the nearly 20 percent rise in fee revenue since Republicans started writing budgets far outstrips the 6 percent increase in population since 2010.

In large part, the rise reflects the state’s shifting to students the cost of attending a state college. One line in the fee table — revenue collected from “tuition and fees” — is more than $600 million higher than it was in 2010.

Republicans hardly invented lawmakers’ preference for raising fees instead of taxes. With Democrats in control, total fee revenue more than doubled from 2000 to 2010, rising from $1.8 billion to $4.4 billion. And the tendency is not confined to North Carolina. Arturo Perez, a fiscal analyst at the National Conference of State Legislatures, said, “Over the last 10 years or so we’ve seen fee increases occur at the state level where in the past it would have been a tax increase.”

But the continued rise in fees under Republicans undercuts their claim of returning money “to hard-working North Carolinians.” Middle-income families may save a few hundred dollars thanks to cuts in the state income tax, but they’ll lose money back to an expansion of the sales tax and higher fees.

Fees should be directly related to the cost of delivering a service. Some revenue from state fees does go directly to agencies. But higher fees are also being used to increase general revenue, making them back-door taxes. In 2015, the legislature ordered an increase of about 30 percent for DMV fees, enough to generate an additional $150 million a year for road and bridge improvements. These broad increases are the most regressive because a person often has no choice but to pay a fee.

Increases in court fees and fines are the most egregious. They are often imposed on people who are unable to pay and who then accrue more fees for failure to pay. The Charlotte Observer recently reported: “Fines and court costs generate $700 million for the state’s general fund – much of it fueled by General Assembly decisions to increase court fees by 400 percent over the past 20 years.”

UNC law professor and N&O contributor Gene Nichol, along with researcher Heather Hunt, recently released a report for the North Carolina Poverty Research Fund that focuses on the injustice of using higher court fees and fines to fund North Carolina’s courts.

The report’s conclusion says in part: “It deprives many poor defendants of the essentials of due process, frequently leading to incarceration and other punishments based merely on their poverty.”

The report further notes that funding courts through what amounts to user fees doesn’t work. Rates of collection are low and court debt can lead to incarceration that costs taxpayers more than what’s owed.

The growth in state fees comes amid an increase in fees in the private sector. Banks have made billions of dollars charging high fees on overdrafts, credit card companies have done the same with late fees and the airlines have stuck with baggage fees imposed to offset rising fuel costs even as the cost of oil has fallen.

Fair dealing requires that fees should be modest, necessary and directly applied. Otherwise, businesses should honestly raise their prices and governments should openly raise taxes to support government services. A fee for service should be just that. It shouldn’t be an opportunity to exploit customers or a way to lower taxes and fund government operations by more regressive means.

— The News & Observer